Darby Brilliant Beginnings is a Kindergarten to Career Savings Initiative.

A Career Savings Plan Can Make a Huge Difference

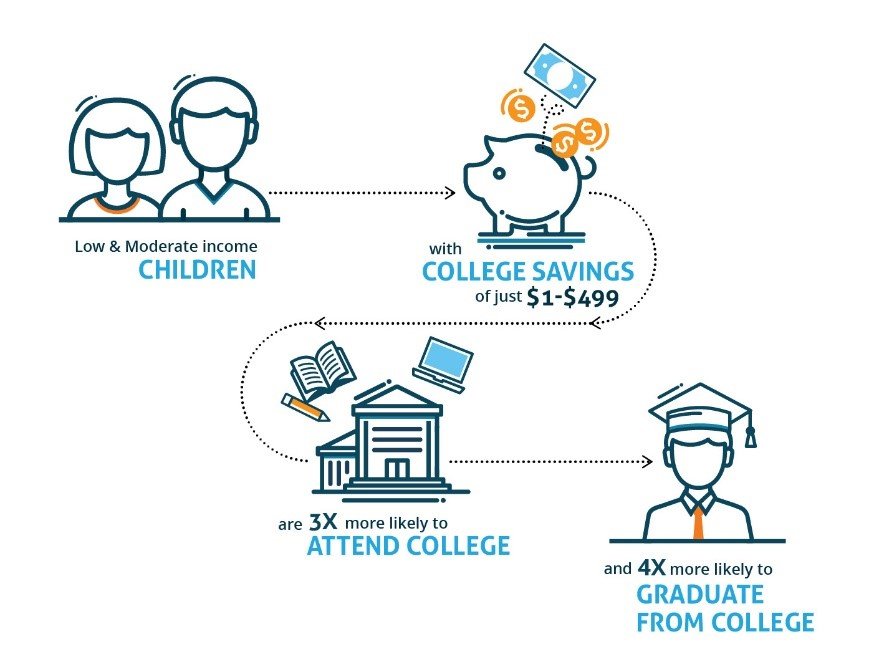

Investing early in a child’s future pays off for a lifetime. Students who graduate from college or vocational training programs experience better career outcomes, including:

Access to better job opportunities

Greater job stability and ability to avoid layoffs

Higher lifetime earnings

No matter your path, DBB helps plan, save, and succeed.

Financial Literacy

Plan. Learn. Save. Succeed.

Darby Brilliant Beginnings (DBB) provides students age-appropriate financial literacy education, led by volunteers, to help students learn to Save Steady and Save Often- building healthy money habits to support their future.

After completing each year’s lesson, students earn a financial incentive deposited into their DBB Savings Account, helping prepare for their future while building lifelong money skills.

Start early. Build confidence. Invest in the future.

*Incentives vary by year, based upon generous donations and student population.

How Does My Savings Account Work?

Start Strong with Darby Brilliant Beginnings

When your child starts kindergarten at Darby Public Schools and applies for a Career Savings Account through Darby Brilliant Beginnings (DBB) they start with a $100 deposit from the program!

*If your child doesn’t start kindergarten in Darby, but enrolls in Darby Public Schools later, they can open a Career Savings Account the year they begin school here, with a $20 deposit to get them started.

Financial Incentives are available to each student, every year that they are enrolled in Darby Public Schools.

Here’s How It Works:

Accounts are held at Bitterroot Community Federal Credit Union (BCFCU)

Accounts are Deposit-only Savings Accounts

Accounts are managed by DBB

You can make deposits online, by mail, through auto deposit & in person at BCFCU

Parents, guardians and loved ones are always welcome to contribute!

Accounts grow through incentives, family contributions, and matched savings

*DBB accounts do not affect the eligibility of your child in regard to grants, scholarships, public assistance or financial aid. These accounts are held by DBB in your child’s name and do not need to be disclosed when applying for those benefits.

Bitterroot Community Federal Credit Union

P.O. Box 467

218 South Main Street

Darby, MT 59829

(406)821–3171

www.bitterrootcommunityfcu.com

✅ No Fees. No Risk. Just Opportunity.

Fee-free accounts– There’s no cost to you or your family.

No impact on public assistance– These savings won’t affect eligibility for programs like SNAP, TANF, or Medicaid.

Won’t reduce financial aid– funds are held by the DBB program for your child’s benefit, they do not need to be reported on financial aid or public benefit applications.

How can DBB Funds be Used?

Flexible Options for a Bright Future

College isn’t one-size-fits-all and neither is success. That’s why Darby Brilliant Beginnings funds can be used for many post-secondary pathways, including:

College

Community college

Trade or Technical Schools

Vocational training

Apprenticeship programs

Business Option: With approval from the DBB Board of Directors, students may use funds to start a business, as long as they present a solid, well-developed business plan.

Beginning a Career: With approval from the DBB Board of Directors, students may use funds for this option.

When Can Funds Be Accessed?

After graduating from high school (or earning an equivalent diploma) and starting on a qualifying post-secondary track.

*If your child decides not to access their funds through an approved path, saved funds (your contributions only) will be returned to them three years after high school graduation (or equivalent). Any incentives or matching funds contributed by DBB will be returned to the program.